CEO fraud is one of the most damaging forms of phishing attacks because it targets authority at the top of an organization. By impersonating executives, attackers exploit trust, hierarchy, and urgency to manipulate employees into making high-risk decisions.

Executive phishing attacks rarely involve malware or suspicious links. Instead, they rely on believable business context and pressure to act quickly. This article explains how CEO fraud works, why executives are targeted by phishing, and how these attacks bypass traditional security controls.

Quick Navigation

What Is CEO Fraud in Phishing Attacks?

CEO Fraud Definition in Executive Phishing

CEO fraud is a type of phishing attack where attackers impersonate senior executives to manipulate employees into transferring money, sharing data, or bypassing controls.

CEO fraud phishing attacks typically involve:

-

Urgent requests from “executives”

-

Confidential or secret instructions

-

Financial or data-related actions

This attack type builds on the principles explained in Business Email Compromise (BEC) Attacks Explained

Why Executives Are Targeted by Phishing Attacks

Executive Phishing Targets Authority and Trust

Executives are targeted because:

-

Their names carry authority

-

Employees hesitate to question them

-

Their roles justify urgent requests

Attackers exploit organizational hierarchy, reinforcing manipulation tactics discussed in The Role of Trust, Fear, and Urgency in Social Engineering

How CEO Fraud Phishing Attacks Work

CEO Fraud Attack Process Explained

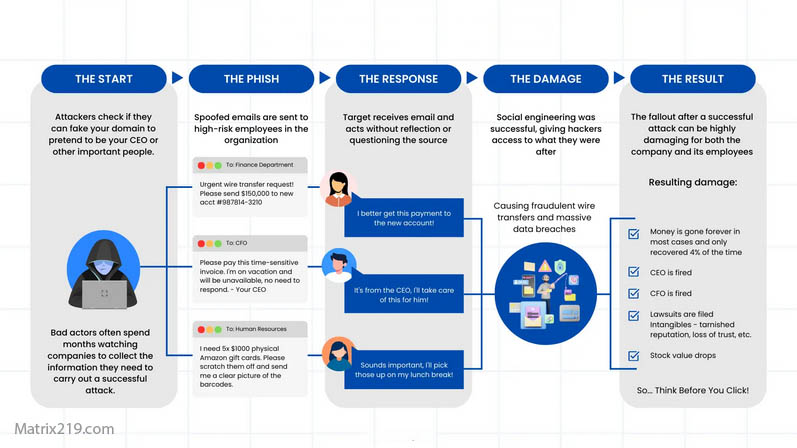

A typical CEO fraud phishing attack follows this process:

-

The attacker studies the executive’s role and style

-

A spoofed or compromised email is prepared

-

An urgent or confidential request is sent

-

The employee complies without verification

This process mirrors early stages of the Social Engineering Attack Lifecycle: Step-by-Step Breakdown

Common CEO Fraud Phishing Scenarios

Urgent Payment CEO Fraud Attacks

Attackers request:

-

Wire transfers

-

Gift card purchases

-

Emergency payments

These requests are framed as time-sensitive and confidential.

Data Request CEO Fraud Attacks

Some CEO fraud attacks focus on:

-

Employee records

-

Financial documents

-

Internal reports

Even without money involved, data exposure can be severe.

Why CEO Fraud Attacks Are So Effective

Why Executive Phishing Bypasses Security

CEO fraud succeeds because:

-

Emails appear legitimate

-

Requests match executive behavior

-

No malware is used

This explains why executive phishing often outperforms technical attacks, as discussed in Why Social Engineering Attacks Are More Effective Than Malware

CEO Fraud vs Other Phishing Attacks

Differences Between CEO Fraud and General Phishing

Compared to mass phishing:

-

CEO fraud is highly targeted

-

CEO fraud relies on authority

-

CEO fraud causes higher impact

These traits make CEO fraud especially dangerous.

CEO Fraud Red Flags Employees Miss

Warning Signs of Executive Phishing Attacks

Common CEO fraud red flags include:

-

Unusual urgency

-

Requests for secrecy

-

Deviations from normal executive behavior

-

Pressure to bypass verification

These signals overlap with patterns covered in Common Social Engineering Red Flags Most Users Miss

How CEO Fraud Attacks Bypass Technical Controls

Executive Phishing and Valid User Actions

CEO fraud attacks bypass controls by:

-

Using trusted identities

-

Triggering legitimate approvals

-

Avoiding malicious links

This aligns with how social engineering bypasses security tools, as explained in How Social Engineering Attacks Bypass Technical Security

How Organizations Can Prevent CEO Fraud

Defending Against CEO Fraud Phishing Attacks

Effective prevention includes:

-

Mandatory verification for executive requests

-

Separation of duties for payments

-

Clear policies allowing employees to question executives

-

Executive awareness of impersonation risk

Culture matters as much as technology.

CEO fraud phishing attacks

External Perspective on CEO Fraud Attacks

Law enforcement and cybersecurity agencies consistently warn that CEO fraud causes billions in losses annually, as highlighted in FBI CEO Fraud Warnings

Frequently Asked Questions (FAQ)

What is CEO fraud in simple terms?

CEO fraud is a phishing attack where criminals impersonate executives to trick employees into risky actions.

Are CEOs actually involved in CEO fraud?

No. Attackers only impersonate executives without their knowledge.

Is CEO fraud only an email-based attack?

Mostly email, but it can also involve SMS or phone calls.

Why don’t employees question CEO requests?

Because authority, urgency, and fear of consequences discourage verification.

Can CEO fraud be completely prevented?

Risk can be reduced significantly with verification and awareness, but not eliminated entirely.

Conclusion

CEO fraud shows how phishing attacks exploit authority rather than technology. By impersonating executives and applying urgency and secrecy, attackers bypass controls designed to stop malware and exploits.

Understanding how executive phishing works allows organizations to redesign approval processes, empower employees to verify requests, and prevent trust from becoming a security liability.