Social engineering threats facing small businesses are increasing faster than many owners realize. Unlike large enterprises, small businesses often lack dedicated security teams, formal verification processes, and layered defenses—making them ideal targets for human-based attacks.

Attackers know that small businesses rely heavily on trust, speed, and informal communication. By exploiting these traits, social engineering allows attackers to bypass technical security with minimal effort. This article explains the most common social engineering threats facing small businesses, why they are targeted, and where risk is often underestimated.

Quick Navigation

Why Small Businesses Are Prime Targets for Social Engineering

Social Engineering Targets Operational Simplicity

Small businesses often operate with:

-

Fewer employees

-

Shared responsibilities

-

Informal approval processes

These conditions reduce verification and increase reliance on trust, reinforcing vulnerabilities discussed in Why Humans Are the Weakest Link in Cybersecurity

Common Social Engineering Threats Facing Small Businesses

Phishing-Based Social Engineering Attacks on Small Businesses

Small businesses are frequently targeted with:

-

Fake invoices

-

Payment update requests

-

Account suspension emails

These attacks exploit urgency and routine tasks, patterns explained in Why Social Engineering Attacks Are More Effective Than Malware

Vendor and Supplier Impersonation Attacks

Attackers impersonate:

-

Payment processors

-

Service providers

-

Technology vendors

Because small businesses often work closely with vendors, these attacks feel legitimate and bypass scrutiny.

Executive Impersonation in Small Business Social Engineering

In small teams, leadership is easily recognizable.

Attackers impersonate:

-

Owners

-

Managers

-

Finance leads

This tactic mirrors authority-based manipulation discussed in The Role of Trust, Fear, and Urgency in Social Engineering

How Social Engineering Impacts Small Business Operations

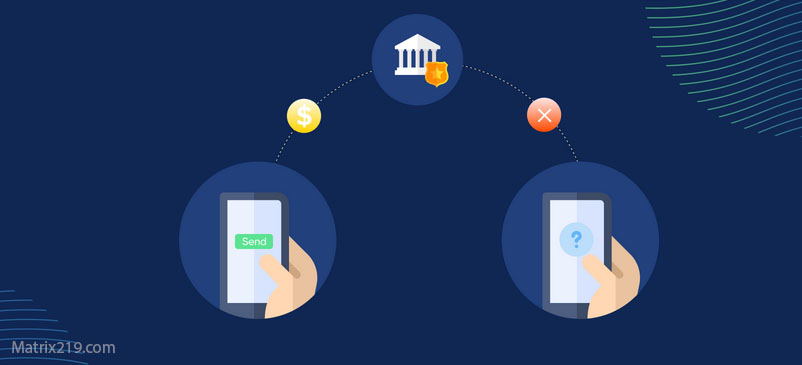

Financial Loss From Social Engineering Attacks

Impacts include:

-

Unauthorized payments

-

Fraudulent transfers

-

Recovery costs

Even small losses can have outsized impact on smaller organizations.

Data and Reputation Damage

Social engineering may expose:

-

Customer data

-

Login credentials

-

Internal communication

Loss of trust can be more damaging than direct financial loss.

Why Small Businesses Detect Social Engineering Late

Lack of Formal Detection Processes

Small businesses often:

-

Lack monitoring tools

-

Rely on individuals to notice issues

-

Discover attacks after damage occurs

This delayed detection follows the pattern outlined in Social Engineering Attack Lifecycle: Step-by-Step Breakdown

Lack of Formal Detection Processes

How Social Engineering Exploits Small Business Culture

Small business culture emphasizes:

-

Speed

-

Flexibility

-

Trust

Attackers exploit these values to push victims into acting quickly without verification.

Reducing Social Engineering Risk for Small Businesses

Practical defenses include:

-

Clear payment verification rules

-

Separation of duties where possible

-

Mandatory callbacks for sensitive requests

-

Awareness training focused on real scenarios

Security does not require enterprise-level complexity—it requires consistency.

External Guidance for Small Business Security

Cybersecurity agencies consistently warn that small businesses face disproportionate risk from social engineering, a concern highlighted in FTC Small Business Cybersecurity Guidance

Frequently Asked Questions (FAQ)

Why are small businesses targeted by social engineering?

Because they often lack formal security controls and rely heavily on trust-based processes.

Are small businesses more vulnerable than large enterprises?

Yes. Fewer resources and informal procedures increase risk.

Do attackers assume small businesses have less security?

Yes. Attackers view them as high-reward, low-effort targets.

Can small businesses afford social engineering defenses?

Yes. Simple verification and awareness measures are often enough to reduce risk significantly.

What is the biggest social engineering risk for small businesses?

Unauthorized payments and credential theft through impersonation.

Conclusion

Social engineering threats facing small businesses exploit trust, speed, and informal operations. Attackers deliberately target smaller organizations because human-based manipulation works where technical defenses are minimal.

Understanding these threats allows small businesses to implement simple, effective safeguards that prevent manipulation without disrupting operations. In social engineering defense, awareness and verification matter more than advanced tools.