How to Recover After an Online Scam is the question most people search after the damage is done. In 2026, recovery is not just about money—it is about stopping escalation, securing identity, and preventing repeat targeting.

Scams are engineered events. Recovery must be structured, calm, and fast. Panic, shame, or denial only increase losses. This guide provides a clear, step-by-step recovery framework that works across scam types.

Step 1: Stop the Bleeding Immediately

The first priority is containment.

Cut all contact with the scammer. Do not reply, explain, threaten, or negotiate. Every response gives scammers information and leverage.

If payments are ongoing, cancel them immediately. If access was granted, revoke it now.

Silence is protection.

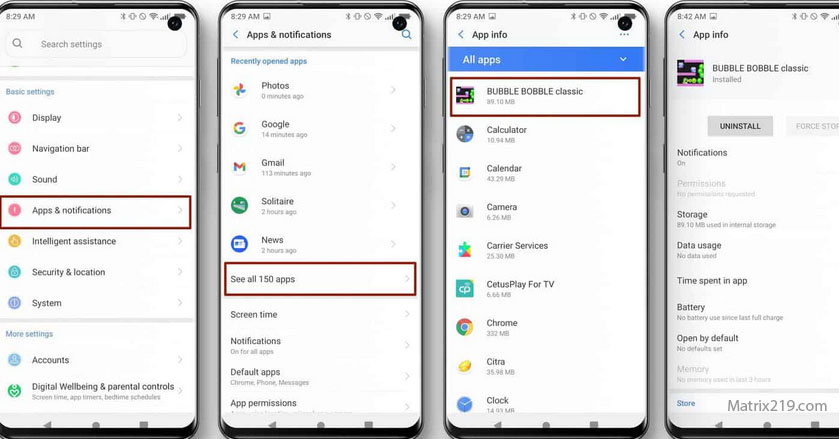

Step 2: Secure Accounts and Devices

Next, lock down access.

Change passwords starting with:

-

Primary email account

-

Banking and payment apps

-

Social media accounts

-

Any account involved in the scam

Revoke active sessions, enable strong authentication, and review recovery options.

Assume anything touched may be compromised.

Step 3: Contact Financial Institutions

Time matters more than certainty.

Notify banks, card issuers, crypto exchanges, or payment platforms immediately. Even if recovery is unlikely, early alerts can freeze transfers, flag accounts, or stop further damage.

Delay closes doors permanently.

Step 4: Document Everything

Create a clean record.

Save:

-

Messages and emails

-

Transaction receipts

-

Wallet addresses or payment details

-

Website URLs and screenshots

Documentation supports disputes, reports, and future protection.

Memory fades. Records don’t.

Step 5: Report the Scam

Reporting helps more than it feels like it does.

Report to:

-

The platform where the scam occurred

-

Financial institutions

-

Consumer protection or cybercrime authorities

Even if recovery fails, reporting disrupts scam operations and protects others.

Silence helps scammers scale.

Step 6: Watch for Follow-Up and Recovery Scams

After a scam, victims are targeted again.

Ignore unsolicited “recovery” offers, investigators, hackers, or lawyers promising results. These are often secondary scams.

Real recovery does not arrive in your inbox.

Step 7: Monitor for Identity Abuse

Scams often trigger delayed damage.

Monitor:

-

Account login alerts

-

Financial statements

-

Credit reports (where applicable)

-

Unfamiliar account activity

Identity misuse may appear weeks or months later.

Recovery is ongoing, not instant.

Step 8: Address the Emotional Impact

Scams cause emotional harm.

Anger, shame, anxiety, and self-doubt are common—and dangerous if they prevent action or reporting. Scammers rely on silence and isolation.

Being scammed is not a personal failure. It is engineered deception.

Step 9: Reduce Future Risk Strategically

Use the incident to harden defenses.

Implement:

-

Clear verification rules

-

Account separation

-

Payment rules for urgency

-

Reduced data exposure

Experience becomes protection when processed correctly.

Step 10: Help Others Avoid the Same Trap

Sharing experience breaks the cycle.

Talking about scams—calmly and factually—helps others recognize patterns before they fall victim. Awareness spreads faster than fraud when silence ends.

Education is recovery.

Why Recovery Is Part of Security

Security is not just prevention.

It includes response, resilience, and learning. A strong recovery reduces long-term harm and future vulnerability.

Preparedness includes knowing what to do after things go wrong.

Recovery in the Full Fraud Framework

This article completes the cycle:

spot → avoid → respond → recover

For the complete framework this article supports, see: Online Scams & Digital Fraud: How to Spot, Avoid, and Recover (2026 Guide)

FAQ

Is it ever too late to recover after a scam?

Recovery options shrink with time, but damage control is always possible.

Should I confront the scammer?

No. Disengagement is safer.

Can reporting actually help?

Yes—especially for future prevention.

Why do scammers return after one success?

Victims are seen as lower resistance targets.

Is recovery mostly technical or emotional?

Both—and ignoring either increases risk.