Recovery Scams are one of the cruelest forms of digital fraud because they target people who have already been harmed. After a victim loses money or access, scammers return—posing as helpers, investigators, lawyers, or “recovery specialists” who promise to get the lost funds back.

In 2026, recovery scams are highly coordinated and often appear immediately after the original scam. Victims are emotionally vulnerable, eager for resolution, and more likely to trust anyone offering hope.

This article explains how recovery scams work, why they are so effective, and how to avoid being scammed twice.

Why Victims Are Targeted Again

Scammers rarely stop after one success.

Victim information is valuable. Details about the original scam, payment method, and emotional response are often shared or sold. This allows follow-up scammers to craft convincing recovery narratives.

From the scammer’s perspective, a previous victim is a “qualified lead.”

Common Types of Recovery Scams

Recovery scams appear in several familiar forms.

These include fake asset recovery services, impersonation of law enforcement or regulators, “ethical hackers” offering to retrieve crypto, legal firms demanding upfront fees, and insiders claiming access to frozen funds.

The promise is always the same: recovery in exchange for payment.

The Illusion of Authority and Legitimacy

Recovery scammers rely heavily on authority.

They use official-sounding titles, fake credentials, stolen logos, and professional websites. Some reference real cases or regulations to sound informed.

Legitimacy is performed convincingly—especially to someone desperate for resolution.

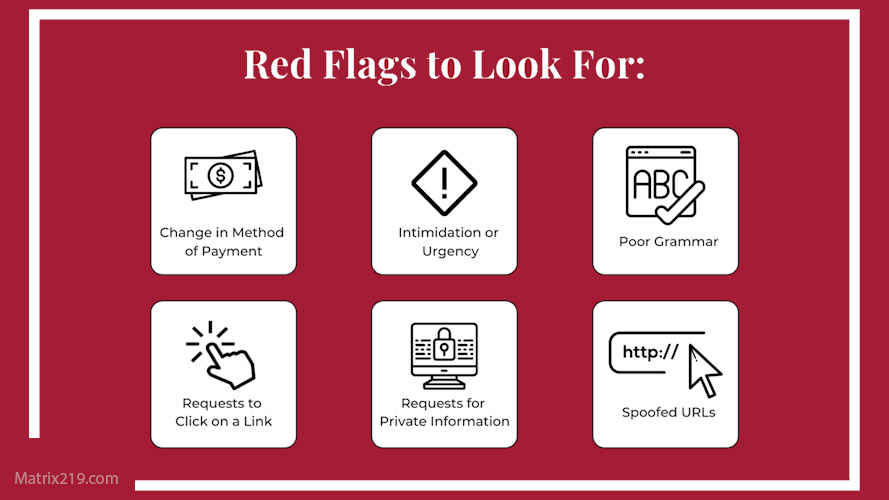

Why Upfront Fees Are a Red Flag

Legitimate recovery processes do not require upfront payments to release funds.

Recovery scammers often demand “processing fees,” “taxes,” “unlock charges,” or “verification costs.” Each payment is framed as the last step before recovery.

There is always another fee.

Phishing Red Flags

Emotional Manipulation After Loss

Recovery scams exploit emotional exhaustion.

Victims want closure, validation, and justice. Scammers provide reassurance, empathy, and confidence—until money is sent.

Hope becomes the lever.

Fake Proof and Fabricated Progress

To maintain trust, recovery scammers provide fake evidence.

This may include forged documents, screenshots of “recovered balances,” or claims that funds are temporarily held pending final payment.

Progress is simulated to justify continued payments.

Why Real Recovery Is Rare

Once funds leave through irreversible channels, recovery is extremely difficult.

Real recovery typically involves:

-

Law enforcement investigations

-

Cooperation from financial institutions

-

Time-consuming legal processes

Anyone promising fast, guaranteed recovery is lying.

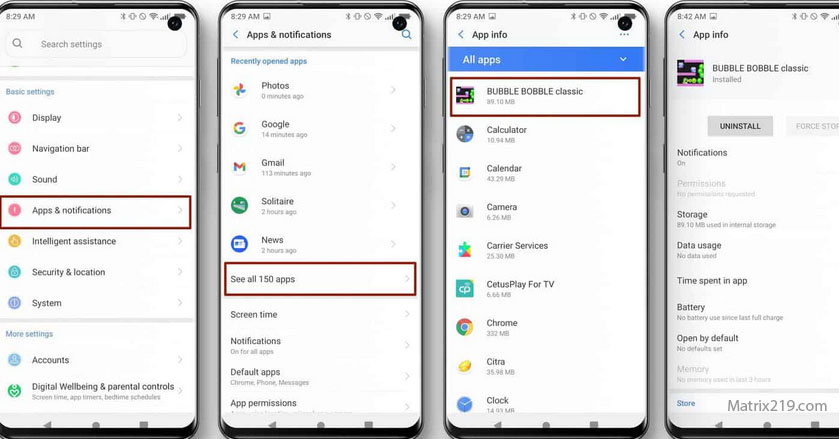

How to Protect Yourself After Being Scammed

After a scam, protection matters more than pursuit.

Key steps include:

-

Ignoring unsolicited recovery offers

-

Verifying claims through official channels only

-

Reporting scams to platforms and authorities

-

Seeking advice from consumer protection agencies

Silence and verification are safer than engagement.

What To Do If You Engaged a Recovery Scammer

If you already interacted:

-

Stop all communication

-

Do not send additional payments

-

Document all interactions

-

Report the scam

Disengagement limits further harm.

The Cycle of Re-Scamming

Recovery scams thrive because shame keeps victims quiet.

Breaking that cycle through reporting and education reduces repeat targeting—not just for you, but for others.

Fraud networks rely on silence.

Recovery Scams in the Larger Fraud Ecosystem

Recovery scams are the final layer in many fraud chains.

They demonstrate why fraud prevention must include post-incident awareness, not just detection.

Understanding recovery scams protects victims when they are most vulnerable.

For the full fraud framework this article supports, see: Online Scams & Digital Fraud: How to Spot, Avoid, and Recover (2026 Guide)

FAQ

Can anyone really recover stolen crypto or funds?

Rarely, and never with guarantees.

Are all recovery services scams?

Most unsolicited ones are.

Why do recovery scammers know details about my case?

Victim data is often shared or leaked.

Should I trust “ethical hackers” offering help?

No. This is a common recovery scam persona.

What is the safest action after a scam?

Secure accounts, report the incident, and ignore recovery offers.